In this article, we will discuss flat valuation and assess methods of estimating a flat's worth. You will need a valuation when you want to buy or sell a flat.

For flat owners, valuation is needed to list flats on the market. On the other hand, buyers need to determine a flat's market worth to receive value for money. Individuals make sure they do not pay more than what a flat is worth.

There are several ways to know the market value of a flat. We discuss some of these methods in this section.

There are several flat valuation calculators online that you can take advantage of. We at RealAdvisor allow you to conduct a free valuation of a property within 3 minutes.

An online flat valuation estimator is a tool that allows you to estimate the value of your flat without having to physically visit the property. This can be useful if you are looking to sell your flat or if you are considering buying a flat and want to know how much it is worth. To use an online flat valuation estimator, you will need to input some information about the property, such as its address, size, and age. You will also need to provide information about the local area, such as the average house price in the area. Once you have input all of this information, the estimator will use this to calculate an estimated value for the property.

Flats come in similar designs, even in the same building. Therefore, obtaining the current market value may not be difficult when compared with similar flats.

There is a long list of flats on sale in the UK on the internet. The land registry data can also assist you with the prices of sold properties.

You can compare your flat to similar listed flats to have a general idea of what your flat could be worth. However, you must ensure that these similar flats you are comparing to must be within the same or similar geographical area.

Price behaviours and impact are different in different places. A flat outside a city will cost different from the same flat in a city. When the overall demand for flats in a place is very high prices are likely to be huge.

To achieve this;

Critical research from these sources and other credible ones informs you whether overall prices are falling or rising and what price floor or ceiling your flat may fall in.

Surveyors are those professionals who can help you to evaluate your flat. They also consider the factors named earlier when conducting an evaluation. In the UK, expect to pay not less than £200 for a professional flat valuation, depending on the type of flat.

Local real estate agents also can assist you with a valuation. They are abreast with current market behaviours and can guide you on how much your flat is worth.

This approach is for rental income and not an outright sale of the property. When leasing out a flat for a short term, the value of the flat for the leased years is the current and projected incomes you estimate to receive. Projected incomes are discounted to obtain the present value of the flat.

To add value to your flat, here are a few tips:

A valued flat gives several benefits some of these are;

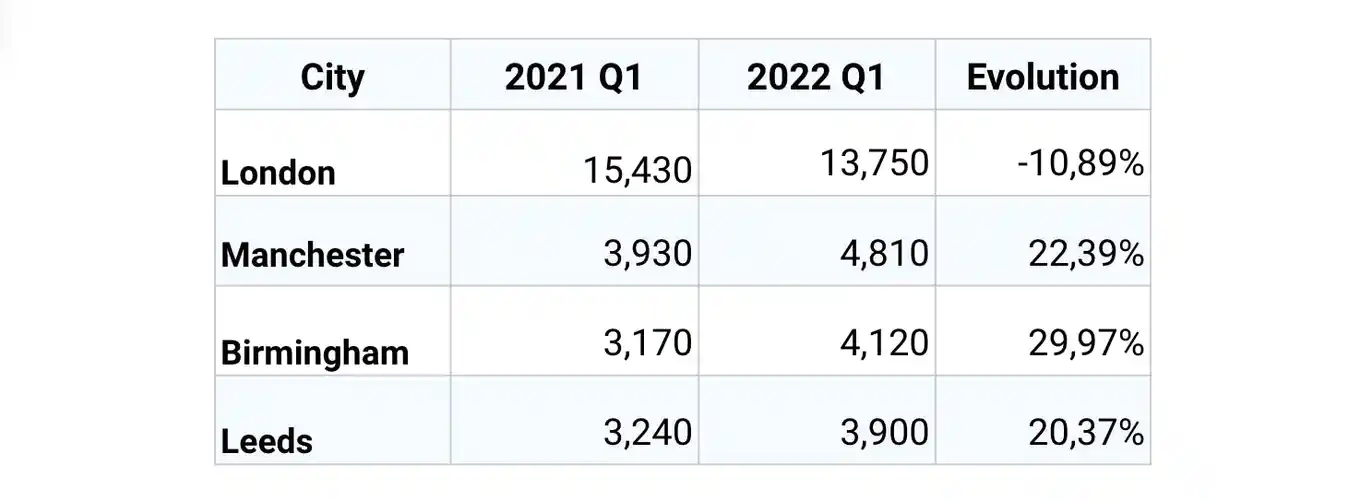

Cost of an apartment decreased and increased at different places between 2021 and 2022. Below is a table showing the average cost of apartments in the UK by the city in the first quarters (in euros per square metre).

From the above table, London saw a decrease in the average cost of apartments in the first quarter this year while the remaining cities experienced a rise in average cost of an apartment.

In the UK today, you need over £1,000 to afford a flat monthly on average. The cost of a one-bedroom flat in the centre of a city in the UK averages £1,745 monthly. A similar flat on the outskirts of cities is £1,230 monthly on average.

In downtown areas, similar flats could cost rent between £1205 and £2200 monthly. Those in the periphery will cost you £900 to £1,500 monthly.

A large flat for rent will mean you need to estimate over £3,000 monthly. For example, a three-bedroom flat sited in the city centre in the UK now can cost a rent of £3,140 on average. Engaging in further checks could reveal that people pay between £2,251 and £5001 for renting a three-bedroom flat.

A three-bedroom flat outside the city has a rent ranging from £1,701 to £2,801 with an average of £2,056.

The current market affects the value of your flat. COVID-19 has had a drastic impact on the purchase of some types of flats. The pandemic has caused a decline in the demand for some types of flats, leading to declining in flat value.

According to Bloomberg, the demand for flats has fallen by 11% in April this year compared to its peak in August 2020. They make an analysis of the Land Registry data and reveal that there has been a reduction in flat sales by £400,000.

This was said to be due to those flats without spaces. According to them, people are unwilling to pay for such housing units due to the difficulties experienced during COVID-19. They indicated that prices fell in places (Greenwich, Tower Hamlets, and Lambeth) where flats are rampant.

Notwithstanding, those who could still manage such flats will benefit by paying less for them.

If you are planning to undertake a valuation of a flat or any property, contact us RealAdvisor for an accurate assessment of the property, and you will know why most buyers want to do business with us.

Flat valuation and its worth can be implemented by understanding the following:

Local real estate agents normally do not charge for flat valuation as a way to be contracted to sell the property. This is mostly a marketing strategy for these local agents, but remembers there is no free lunch. The resources spent are always captured in their sale commission.

Yes, because buyers will always negotiate, selling agents add a percent of 8% to 15% to the actual fair or market price.

5 min