Creating a value opinion for a piece of land is the land valuation process. An in-depth analysis and survey are used to determine the worth of land. It is the cost of a plot of land after future improvements are factored in. It considers the entire neighbourhood, such as the amount of open space or the local average income. Here are some factors to consider when evaluating your land:

It will be challenging to build water and drainage lines if the land's level is higher than the nearby road. To make the plot at a reasonable level, additional earth needs to be excavated. In a similar vein, landfilling will be quite expensive if the property is significantly below road level. You should consider all of these levelling costs when determining the value of a piece of land.

The value of land is also influenced by the soil's bearing capacity. The foundation's price will be fair if the soil's bearing capacity is good. However, if the soil-bearing capacity is inadequate, the price of a foundation may increase dramatically. As a result, land with good soil-bearing capacity will cost more.

The accessibility of a piece of land affects its value as well. A plot of land will sell for significantly less if it is landlocked or if the access road is too narrow.

Due to affordability, smaller residential plot sizes typically command greater per-unit prices than larger ones. Larger plot sizes, however, could be more expensive if the land can be used for industrial or commercial reasons.

As they say, location, location, and location are everything in real estate. The location of the land is the primary determinant of its value. The land is more expensive in urban areas than it is in rural ones, and land near the city centre is worth more than land on the outskirts.

Land that is wider and faces a street or road is more expensive. The value of land is also influenced by how far it is from the main road. A land that faces the main road is substantially more expensive than one that is located four or five streets away.

Compared to industrial or residential land, commercial land is more valuable. In a similar vein, industrial and residential properties are worth more than farmland. Therefore, it's crucial to establish the use of the land before estimating its cost.

The sales comparison approach contrasts recently-sold nearby lands that are comparable to the in-question property. Price adjustments are then made for variations between the subject property and the similar property. The important factors to consider can be divided into transaction characteristics and asset characteristics:

Example:

An area's topography may refer to the actual land shapes and features or a description of them (especially their depiction in maps). The eventual land value is greatly influenced by the state of the property.

Basically, it involves studying or knowing the actual elevations of the land, which includes hills, ravines, and valleys, or it is just a flat piece of land. This is important because if you want to build or really do anything on the land, you really have to know whether it is buildable, whether the building is going to be on a cliff or on a steep slope.

This approach to evaluating your land gives you a firm ground on the worth of your land. For instance, if you want to sell your land to a buyer who would want to build on it, then your market price for the land could surge up if your land is a flat piece of land rather than one that has valleys and cliffs.

You can get the topography of your land by simply using the google earth app. You simply enter the latitudinal and longitudinal coordinates of your land and in seconds you get your results. It is completely free!!!

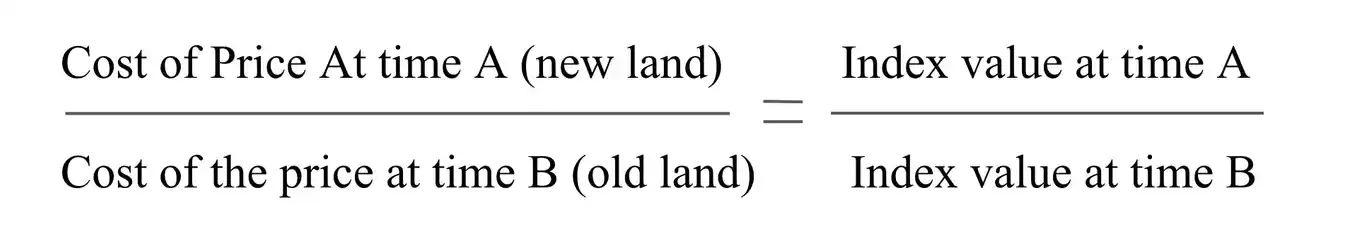

The cost index explains variations in cost element prices in relation to the chosen base year. Different cost factors are weighted together according to their shares of the total expenses when calculating cost indices. It involves the use of the sales comparison method with the help of the UK Land Price Index from the land registry data to determine the price of similar lands to your land. This method is determined by this equation:

Example

Let us say that land that is similar to your land was sold in 2005 for a price of 120,000 and you would want to determine how your land which is similar to the already sold land in this time would also cost.

It could be that the land is leasehold land; here the income capitalization method is employed to convert ground lease into land values

Two subcategories of this strategy exist:

The fair market value of the land is calculated using a market-derived land capitalisation rate after the expected market rental value of the land is capitalized. For the greatest and best possible use of the land, market rent and capitalization rates should be used.

The net operating income of land is divided by its current market value to determine the capitalization rate.

Example:

The general formula for calculating the ground rent is Income/Rate = Value (I/R=V)

Example:

This method turns the allotted percentage of a property's income that is related to the land and again divides it by a land capitalization rate that is generated from the market, similar to the Ground Rent Capitalization methodology previously discussed. In evaluations of the highest and best uses, this method is most frequently used to determine the viability of alternative uses.

Example:

Suppose a property’s income of a building is £30,000 per annum and the allotted income for the land from the annual income is £10,000. Then still using the above capitalization rate (8%) the land value on which the building becomes:

The main distinction between this method and the one before is that revenue for an improved property is often the starting point, and it needs to be divided (with market support) into income attributable to land (IL) and income attributable to the building (IB).

This technique is used to determine the worth of such land that can be developed to realise its full potential. For instance, agricultural property that has been converted to residential usage can be developed into a township with multi storey structures and residential lots. To determine fair market value, the development technique takes into consideration the entire development potential of the site. Location, use, floor space index (FSI), and soil type are significant considerations when using this land value approach.

For instance:

By inexperienced new landlords, determining land basis is a crucial step that is frequently missed. A building's land and structure are both included in the purchase price. Both the building and the land need to be given a value. To achieve this, divide your purchase price between the structure and the land. If you inadvertently allocate the entire purchase price to the building rather than dividing the value between the land and the building, you will be depreciating the land. Land cannot be depreciated; hence this is a concern. The property tax card for the building must be located to divide the purchase price between the building and the land. The local property assessor's office or website can be accessed for this purpose.

The tax card will give you a value for the land and a value for the building. You will take those percentages and apply them to your purchase price.

Determining the value and appraising the land has a lot of considerations to take into account for you to have satisfied your due diligence. Notwithstanding, it's essential and we hope we’ve made it easily digestible for you. Just remember to research, from land conditions to surrounding properties and it’s hard to go wrong.

Do contact us at RealAdvisor.co.uk for any questions or queries you may have. We are ever ready to offer assistance.

If no one else has a superior claim to the gold, you can usually keep it if you find it on your property or on public grounds. Most states require that finds be reported to the police so that they can be marketed. You are then permitted to keep it unless someone else can demonstrate ownership.

In terms of importance, the desert biome ranks among the top. 13 of the 15 different types of mineral deposits that exist on Earth are found in deserts. Because of its mineral resources and significance to the local and global economies, the desert.

5 min